|

|

GOLD MINES DEVELOPMENT LOANS RULES, 1952

[G.N. 1031/1952, G.N. 186/1953, G.N. 1498/1953, G.N. 808/1954, L.N. 67/1956, L.N. 142/1963, L.N. 761/1963, L.N. 278/1969, L.N. 218/1986.]

RULES UNDER SECTION 17

| 1. |

Citation

These Rules may be cited as the Gold Mines Development Loans Rules, 1952.

|

| 2. |

Interpretation

In these Rules, except where the context otherwise requires—

“business” means the business of mining for gold in Kenya;

“company” means a company as defined by the Companies Act ( Cap. 486), and a company incorporated outside Kenya which has delivered to the Registrar of Companies the documents and particulars specified in section 366(1) of that Act;

“director” has the meaning assigned to it in the Companies Act ( Cap. 486), and also includes a person who—

| (a) |

is the manager of the company or otherwise concerned with the management of its business; and

|

| (b) |

is remunerated out of the funds of the business; and

|

| (c) |

is the beneficial owner of not less than 20 percent of the ordinary share capital of the company;

|

“ordinary share capital” means all the issued share capital (by whatever name called) of the company, other than capital the holders whereof have a right to a dividend at a fixed rate but have no other right to a share in the profits of the company;

“total income” has the meaning assigned to it in the Income Tax Act ( Cap. 470), but shall be deemed to apply only to the business of gold mining for the purposes of these Rules.

|

| 3. |

Notice of application for loan

| (1) |

Written notice, not less than thirty days in advance of the commencement of any work in respect of which it is intended to apply for a loan, shall be given to the Warden of the Mining District in which the gold mine is situated; and as soon as practicable, but in any case within thirty days after the receipt of the notice by the Warden, an officer of the Mines and Geological Department shall visit the mine and choose points of reference from which the necessary measurements can be taken, and shall measure the excavations.

|

| (2) |

Written notice, not less than fifteen days in advance of the expected date of the termination of the work upon which the application for the loan is based, shall be given to the Warden; and an officer of the Mines and Geological Department shall visit the mine as nearly as may be practicable upon the date so given for the termination of the work, and shall make the measurements necessary in connexion with the application.

|

|

| 4. |

Mode of application

| (1) |

Applications for loans shall be submitted to the Commissioner of Mines and Geology through the Warden of the Mining District in which the gold mine is situate.

|

| (2) |

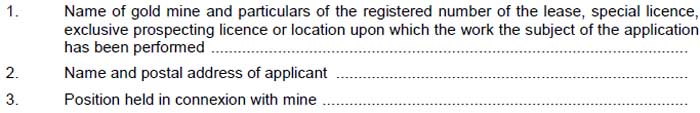

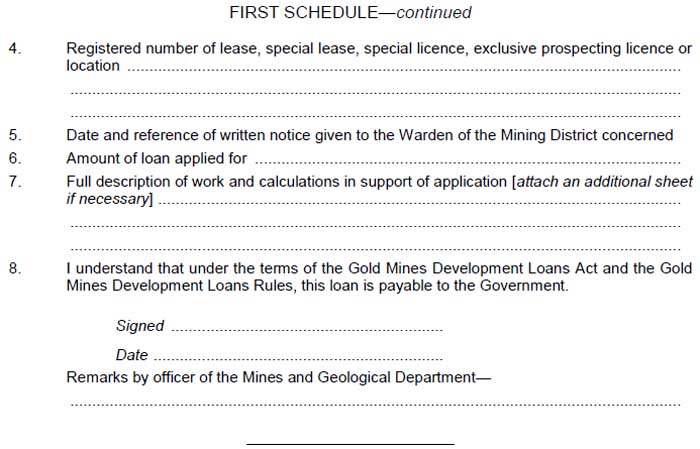

All such applications shall be made in the form in the First Schedule.

|

|

| 5. |

Meetings of Board

The Board shall meet at intervals for the purpose of considering applications.

|

| 6. |

Calculation of development and rate of payment

| (1) |

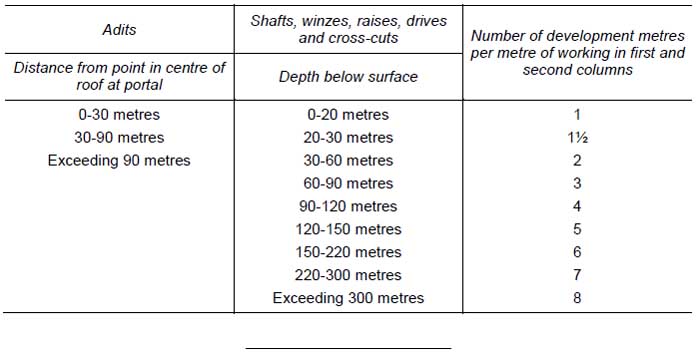

Subject to rule 8, development in respect of shafts, drives, cross-cuts, winzes, raises and adits for the purpose of an application for a loan shall be calculated in accordance with the table set out in the Second Schedule.

|

| (2) |

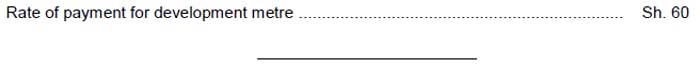

For the purpose of assessing a loan, the rate of payment per development metre shall be as set out in the Third Schedule:

Provided that, in the case of a mine producing gold in conjunction with other minerals, the amount of the loan shall be reduced by multiplying it by the ratio that the value of the gold bears to the total value of mineral sold during the accounting period immediately preceding the application.

|

|

| 7. |

Measurements

For the purpose of making calculations in connexion with any application for a loan, the following shall apply—

| (a) |

in the case of workings to which access is given by one shaft, the depth of the workings and of the shaft providing access to them shall be taken as the distance in metres, measured along the longitudinal axis of the shaft, from the shaft collar;

|

| (b) |

in the case of workings to which access is given by two or more shafts, the Board shall use its discretion, taking into consideration the technical advice of the Mines and Geological Department, as to which shaft is the more important in determining the cost of operating any particular face, and shall apply a depth factor commensurate with the depth below that shaft collar;

|

| (c) |

in the case of a level to which access is obtained by means only of an adit, the factor to be applied to any working shall be determined by the distance along the adit from its portal at which the working communicates with the adit.

|

|

| 8. |

Work not to count

The following shall not count as development work for the purpose of such calculations—

| (a) |

stope drives, box holes and any excavations which in the opinion of the Board do not constitute true development work;

|

| (b) |

any drive, cross-cut, winze, raise or adit having any area of cross-section of less than 1.5 square metres;

|

| (c) |

any shaft or adit which has been sunk to a total incline or vertical depth of less than 16 metres from the surface level or point of entry;

|

| (d) |

any cored borehole designed to produce a core of less diameter than twenty-two millimetres.

|

|

| 9. |

Borehole to be kept available for measurement

| (1) |

In order to qualify for a loan, a borehole shall be available for measurement until measured by an official of the Mines and Geological Department, or for a period of three months after completion; and all practicable steps shall be taken by the applicant to preserve in their correct sequence any core, fragmented rock chippings and sludge from each borehole and to make them available to the Mines and Geological Department for inspection and assay.

|

| (2) |

Applicants for a loan shall keep and submit to the Board accounts showing the direct cost (in power, bits and wages of crew, and in cement and such materials when their use is necessary) or the contract cost of each borehole.

|

| (3) |

Subject to section 10 of the Act and rule 8 the loan shall be assessed at 75 per cent of the cost as calculated on the basis of paragraph (2) of this rule.

|

|

| 10. |

Accounts to be kept

Applicants for a loan shall keep and submit to the Board accounts showing the direct cost (in power, bits and wages of crew, and in cement and such materials when their use is necessary) or the contract cost of each borehole.

|

| 11. |

Calculation of loan

Subject to the provision of section 10 of the Act and of rule 8 of these Rules, the loan shall be assessed at 75 percent of the cost, as calculated on the basis of rule 10.

|

| 12. |

Repayment of loans

| (1) |

A loan shall be repayable to the Government by the owner or his successor in title of the mine in respect of which such loan was made upon such terms and conditions as the Board may decide:

Provided that the Board shall ensure that such repayments shall not affect adversely the profit-earning capacity of the mine.

|

| (2) |

In the event of a change of ownership of a mine in respect of which a loan has been made, the new owner shall, with the concurrence of the Board, execute a document whereby the liability for repayment of the loan is accepted by the new owner in discharge of the liability of the original owner.

|

| (3) |

The method that shall be used to assess profits and, thereafter, loan repayments shall be that set out in the Fourth Schedule.

|

|

| 13. |

Appeals

An appeal against a refusal of the Board to grant a loan shall be made in writing to the Minister within thirty days of the announcement by the Board of the award or decision to which it refers.

|

FIRST SCHEDULE [Rule 4, L.N. 67/1956.]

APPLICATION FOR A LOAN UNDER THE GOLD MINES DEVELOPMENT LOANS ACT

SECOND SCHEDULE [Rule 6(1), L.N. 278/1969.]

CALCULATION OF DEVELOPMENT

THIRD SCHEDULE [Rule 6(2), G.N. 1498/1953, L.N. 278/1969. ]

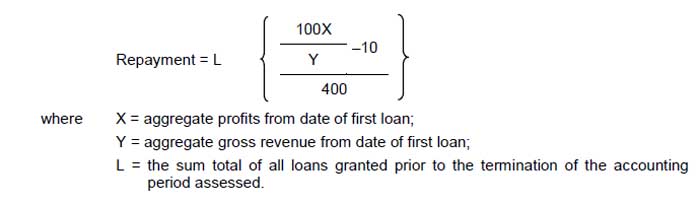

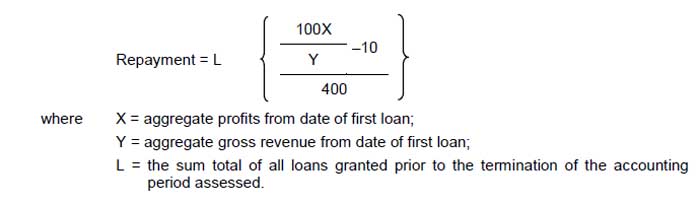

FOURTH SCHEDULE [Rule 12(3), L.N. 278/1969.]

| 1. |

Rate of repayment

The total amount of loan indebtedness to be repaid in any one accounting period shall be calculated in the following manner—

| (a) |

the aggregate profits from the date of the first loan granted in respect of the mine shall be expressed as a percentage of the aggregate gross revenue from it during the same period;

|

| (b) |

the percentage figure so arrived at shall be reduced by ten;

|

| (c) |

the amount to be repaid shall be one four-hundredth of the latter figure multiplied by the sum of all loans granted up to the end of the accounting period:

|

Provided that in no case shall the sum so assessed exceed five percent of the gross revenue for the accounting period.

The calculation may be expressed algebraically as—

|

| 2. |

Accounts to be kept

Every person carrying on a business shall make up accounts for successive periods (in this Schedule referred to as accounting periods) of not more than twelve months.

|

| 3. |

Computation of profits and gross revenue

| (1) |

The amount of the profits for any accounting period shall be computed in accordance with such of the provisions of the Income Tax Act (Cap. 470) as relate to the calculation of total income for the purposes of that Act, subject to the provisions of paragraph 4 of this Schedule.

|

| (2) |

In determining the ratio of profits to gross revenue as computed under this paragraph, the profits or losses of all accounting periods commencing with that in which any loan under the Act was first granted shall be aggregated and compared with the gross revenue for the same period.

|

| (3) |

No deduction shall be made in respect of any interest, annuity, royalty, rent or other annual payment to the person carrying on the business, and, where such business is carried on by a company the directors whereof have a controlling interest therein, the directors shall be deemed to be carrying on the business.

|

| (4) |

In the case of a company the directors whereof have a controlling interest therein no deduction shall be allowed in respect of directors’ remuneration:

Provided that “directors’ remuneration” does not include the remuneration of any director who is required to devote substantially the whole of his time to the service of the company in a managerial or technical capacity and is not the beneficial owner of or able, either directly or through the medium of other companies or by any other indirect means, to control more than 5 percent of the ordinary share capital of that company.

|

| (5) |

No deduction shall be allowed in respect of any transaction or operation of any nature if and so far as it appears that the transaction or operation has artificially reduced or would artificially reduce the profits.

|

| (6) |

There shall be allowed a deduction for each working proprietor of the business; the amount to be deducted shall be Sh. 24,000 each accounting period of one year, subject however to a maximum total of Sh. 48,000 in respect of the business, and, where an accounting period is less than one year, the amount shall be proportionately reduced so as to correspond with the length of the period.

|

| (7) |

The expression “working proprietor” in subparagraph (6) means a proprietor who has during more than one-half of an accounting period worked full time in the actual management or conduct of the business; “proprietor” means, in the case of a business carried on by a partnership, a partner therein, and, in the case of a company the directors whereof have a controlling interest therein, any director thereof owning more than 5 percent of the ordinary share capital of the company.

|

|

| 4. |

Returns

The Commissioner of Income Tax may, by notice in writing, require any person carrying on the business to furnish him, within three months or such longer period as the Commissioner may deem to be reasonable after the end of an accounting period of such business, with a return of the profits derived from the business for that period, and such other particulars as may be required for the purpose of this Schedule.

|

| 5. |

Persons assessable

| (1) |

Repayment in respect of any accounting period shall be assessed on the person or company carrying on the business during that period.

|

| (2) |

Where two or more persons were carrying on the business jointly during the accounting period, the assessment shall be made upon them jointly and, in the case of a partnership, may be made in the partnership name.

|

| (3) |

Where, by virtue of subparagraph (2), an assessment could, but for his death, be made on any person solely or jointly with any other person, the assessment may be made on his personal representative either solely or jointly with that other person, as the case may be.

|

| (4) |

Where any person liable to assessment is not resident in Kenya, an assessment may be made upon any agent, attorney, manager or factor resident in Kenya through whom the business is carried on during the accounting period, or on an attorney appointed under regulation 42 of the Mining Regulations (Cap. 306, Sub. Leg.).

|

|

| 6. |

Assessment

The Commissioner of Income Tax shall assess every person chargeable with the repayment, and, subject to the provisions of this Schedule, the provisions of the Income Tax Act (Cap. 470), shall apply so far as they are applicable to the assessment of development loan repayment.

|

| 7. |

Appeal against assessment

Any person who, being aggrieved by a loan repayment assessment made upon him and having failed to agree with the Commissioner of Income Tax may, upon giving notice in writing to the Commissioner of Income Tax within thirty days after the date of service upon him of the notice of refusal of the Commissioner of Income Tax to amend the assessment as desired, appeal against such assessment to the Minister, whose decision shall be final.

|

| 8. |

Repayment when due

Any loan repayment assessed shall be due and payable to the Government at the expiration of forty days from the date of service of the notice of assessment, and shall be recoverable as a debt due to the Government from the person on whom it is assessed:

Provided that, where an appeal is pending against the assessment, such part of the assessment as appears to the Commissioner of Income Tax not to be in dispute shall be collected and paid in all respects as if it were repayment charged by an assessment in respect of which no appeal was pending, and, upon the determination of the appeal, any balance chargeable in accordance with the determination shall be paid and any amount overpaid shall be repaid as the case may be.

|

| 9. |

Forms

All forms of returns and other forms required for the administration of this Schedule shall be in such form as may from time to time be specified by the Commissioner of Income Tax.

|

|